Unlocking the Potential of Enhanced Rock Weathering in the Global South

- November 26, 2024

- 5 minutes read

Following PxD’s initiative identifying evidence-based climate change mitigation opportunities for smallholder farmers in the Global South, we are exploring ways to advance these opportunities in credible, inclusive, and equitable ways. This article is the third in a series (see the first and second) detailing PxD’s market-shaping workstream on Enhanced Rock Weathering (ERW), which aims to identify pathways to catalyze a Global South-inclusive ERW industry benefiting people and the planet alike. We thank all the industry stakeholders who offered invaluable advice and feedback as we prepared this blog post. All views are our own.

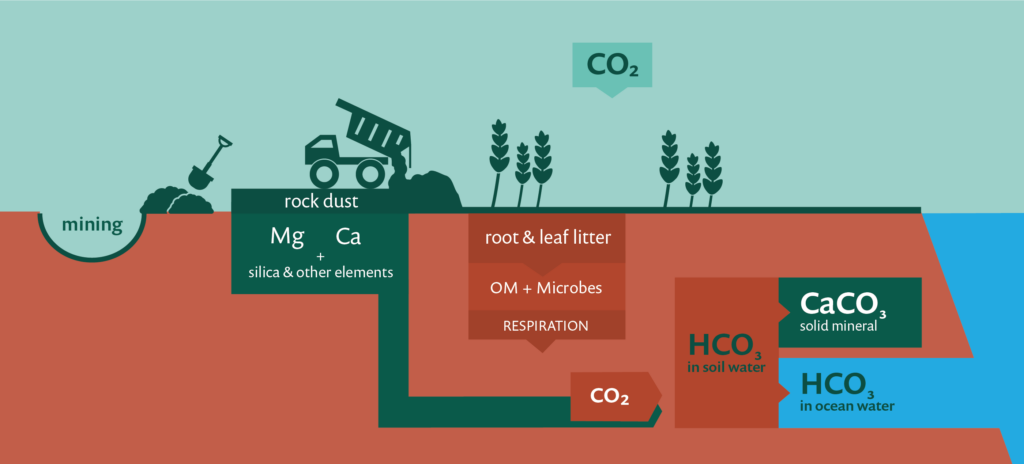

Enhanced Rock Weathering (ERW) is a process that accelerates natural chemical reactions to achieve permanent carbon dioxide removal by applying specific types of finely ground rock to soils. Countries in the Global South present optimal conditions for carbon dioxide removal through ERW due to their high temperatures, humidity, and suitable soils.

In addition, ERW deployments in the Global South can confer critical soil health improvements, benefiting millions of smallholder farmers who rely on agriculture for their livelihoods. By strengthening their climate resilience and supporting sustainable farming practices, ERW deployments in the Global South offer a dual benefit—advancing global climate change mitigation while empowering vulnerable farming communities

However, commercial finance alone is unlikely to develop the ERW market at the scale and speed required while addressing critical distributional impacts. Presently, ERW investments are primarily driven by private sector firms through voluntary carbon market transactions. However, these firms – focused on recovering investments and maintaining competitive advantages – are unlikely to allocate sufficient resources towards the extensive research and development needed to scale ERW across diverse geographies. As a result, the ERW industry remains constrained in both size and scope, with only approximately 250,000 tonnes of carbon dioxide removal sold across all types of enhanced weathering projects to date (“CDR.fyi.”, n.d.). Notably, the majority of these projects are concentrated in the Global North.

ERW presents a unique opportunity to leverage innovative financing strategies due to its dual benefits: carbon dioxide removal and livelihood improvements. PxD’s latest white paper, Creating a Global South-Inclusive Carbon Dioxide Removal (CDR) Market through Enhanced Rock Weathering (ERW) on Agricultural Lands, examines one such approach – an evolved model of the Advanced Market Commitment (AMC) – as a potential pathway to build scale and the ERW market effectively.

Fund Structure

An Advanced Market Commitment (AMC) is a legally binding agreement in which buyers guarantee a future market for a product that meets specific criteria. This incentive encourages private sector investment in products that might otherwise be overlooked.

Traditionally, AMCs have been funded by groups of outcome funders with aligned goals, such as vaccine development. PxD proposes that evolving this model into what we term a “diverse” market commitment involving funders with distinct but complementary objectives, such as climate change mitigation and poverty alleviation, can help catalyze the ERW market. This approach would offer a premium for carbon dioxide removal projects that meet high standards of quality and equity while emphasizing the distributional benefits of deploying ERW in the Global South.

By collaborating with climate funders, development funders could explore ERW’s potential to enhance agricultural productivity and livelihoods—an avenue they might otherwise lack the capacity to pursue. Meanwhile, climate funders could draw from the development sector’s experience scaling innovations across the Global South, enabling ERW to achieve its full CDR potential.

Another key innovation of the diverse market commitment is its fund structure. Instead of using AMC funds solely for direct CDR purchases, the DMC model would allocate funds to pay a pre-agreed, publicly disclosed premium per tonne of carbon removed. This premium incentivizes suppliers to develop competitive products while allowing the actual volume of carbon removal to be driven by external entities interested in purchasing CDR at market rates. By focusing on premiums rather than direct purchases, the DMC could incentivize significantly more carbon removal than direct purchases through the fund could achieve.

Product

To qualify for the premium, firms must demonstrate that carbon has been removed according to a set evidentiary standard and that the removal occurred in a designated set of Global South countries. The premium compensates for the costs associated with implementing and verifying ERW in these regions, which are likely more resource-intensive in the short to medium term due to limited existing institutional support. Additionally, firms must agree to publicly share a predetermined subset of data, contributing to global scientific understanding and advancement of ERW. This data could include operational details such as grain size, agroecological characteristics of deployment land, and resulting carbon dioxide removal rates.

Project Finance

The diverse market commitment is an outcomes-funded instrument, meaning that funds are disbursed only once carbon has been successfully removed. To finance projects, firms will still need to secure working capital from traditional investors. However, the existence of this diverse market commitment provides a strong signal of proven demand for the firm’s product, helping them make a strong investment case. The diverse market commitment’s proven demand for carbon removal in the Global South reduces the investment risk for firms focused on ERW in these regions, as it establishes deployments in these areas as a key factor for meeting market demand.

Unlocking the full potential of ERW as a global public good requires innovative market design and decisive action. Achieving this potential hinges on addressing critical market inefficiencies and financing gaps, particularly for a globally inclusive ERW industry. PxD’s proposed diverse market commitment offers a solution to bridge this financial gap, enabling ERW to provide scalable, permanent carbon dioxide removal and valuable co-benefits to farmers, helping to advance multiple sustainable development goals simultaneously.

PxD values diverse perspectives and welcomes feedback on the ideas shared in this post and future discussions. We believe in fostering dialogue to deepen understanding and explore innovative solutions. If you would like to share your thoughts or engage further, please reach out to us at info@precisiondev.org.

Stay Updated with Our Newsletter

Make an Impact Today