Following PxD’s initiative identifying evidence-based climate change mitigation opportunities for smallholder farmers in the Global South, we are exploring ways to advance these opportunities in credible, inclusive, and equitable ways. This article is the first in a series detailing PxD’s market-shaping workstream on Enhanced Rock Weathering (ERW) which aims to identify pathways to catalyze a Global South inclusive ERW industry benefiting people and the planet alike.

- Enhanced rock weathering (ERW) is a carbon dioxide removal pathway which leverages naturally occurring chemical reactions between certain types of rocks and soils to capture and store CO₂ from the atmosphere.

- ERW is particularly suitable for working lands in the Global South as they have the ideal conditions, e.g. temperature and humidity, for weathering reactions.

- ERW deployment in the Global South can also provide valuable benefits to smallholder farming communities via agricultural co-benefits as well as carbon finance revenue.

- The lack of common and agreed upon monitoring, reporting, and verification (MRV) approaches currently preclude widespread deployment and monetization of ERW, especially for the Global South, in the voluntary carbon markets driven demand ecosystem.

- Innovative financing approaches, like different forms of push or pull funding, can help address this bottleneck by bridging the investment gap for shared aspects of market infrastructure, like MRV.

Photo courtesy CAP-A

Enhanced rock weathering is a nature-based carbon dioxide removal (CDR) technology, with strong applicability to working lands, that can permanently capture and store CO₂ from the atmosphere. As a negative emissions technology, ERW provides farmers an opportunity to contribute to global CDR needs, of which at least 1.5 GtCO₂eq per year is likely required (CDR Primer, 2021) to achieve net zero ambitions, while generating private agronomic benefits from its use as a soil amendment. Through integration with carbon markets, implementation of ERW could also provide farmers with payments for their environmental services, an evidence-based approach to motivate behavior change for achieving environmental outcomes (IPA, accessed 2023).

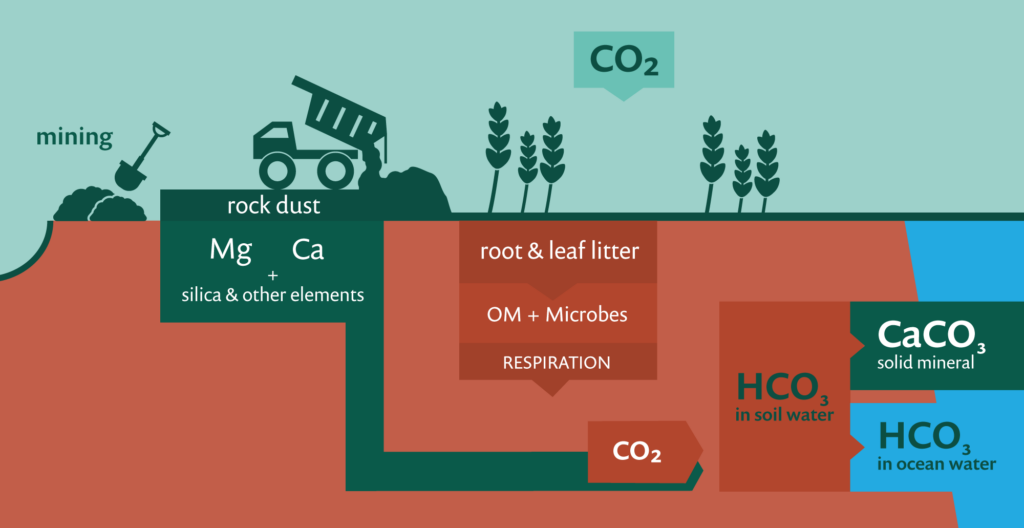

ERW accelerates the natural weathering process of certain types of silicate rocks, for example basalt, through the application of finely ground rock dust to soils. Finely grinding the rock creates greater surface area for the naturally occurring chemical reactions that capture atmospheric carbon and convert it into stable dissolved forms. These stable forms of carbon then flow out through groundwater into the oceans, where they are stored on the scale of thousands of years. Preliminary studies indicate, as an upper bound, ERW’s geophysical potential is between 2–4 Gt CO₂ removed per year (Fuss et al, 2018). As a comparison with another nature-based carbon removal pathway, the geophysical potential of afforestation and reforestation is estimated to be between 0.5–5 Gt CO₂ per year (Fuss et al, 2018). Compared to other permanent carbon removal strategies, carbon removal through ERW is also significantly less energy-intensive, for example requiring half the energy demand of direct air capture for the same CDR range (Eufrasio et al, 2022).

ERW is particularly attractive for application on agricultural lands as it provides the scale at which deployments must be made to match ERW’s carbon removal potential and as there is emerging evidence the kinds of silicate rock powders used in ERW can also improve agricultural productivity (Kelland et al., 2020; Beerling et al., 2023). In particular, ERW’s agricultural and monetary private co-benefits have the potential to be particularly meaningful for smallholder farmers in the Global South, who comprise a large proportion of the world’s poor living on less than $2 a day (CGAP, 2016). Smallholder farmers face many constraints to productivity, incomes and security, whose effects are increasingly compounded by rising temperatures, erratic rainfall and droughts, and extreme weather events wrought by climate change. The deployment of ERW across the Global South could help meet climate goals, contribute to global poverty alleviation aims, as well as provide farmers the agency to decarbonize the agricultural sector.

This article will outline why many countries in the Global South have high potential for ERW deployment, both in terms of achieving carbon removal and contributing to development goals, the current bottlenecks which preclude market catalyzation in the Global South, and how innovative financing mechanisms can help address these bottlenecks to create a more equitable and inclusive ERW industry.

Global South countries are well-suited for Enhanced Rock Weathering

There are several compelling arguments for investing in ERW in countries of the Global South:

A. Many countries in the Global South have the agro-ecological conditions understood to be most conducive for removing carbon through ERW as equatorial/tropical geographies are more likely to have the ideal soil pH, temperature, and moisture conditions for the weathering process, although more empirical data is needed to test these assumptions (Strefler et al., 2018);

B. Globally, the potential of ERW to remove carbon at scale can only be achieved if it is implemented where suitable land is abundant, which means it must include countries in the Global South, which includes five of the top seven countries with the highest CDR potential worldwide (Beerling et al, 2020);

C. The application of ground silicate rock can increase agricultural productivity as the chemical reactions involved in ERW adjusts soil pH, improves soil cation exchange capacity, and increases the presence of critical macro and micronutrients in soils (Amann et al, 2019). Of particular relevance to working lands in the Global South, where soil degradation and increasing acidification are key issues for agricultural productivity (Tully et al, 2015), is emerging evidence that ERW can replace the use of traditional agricultural lime as a soil amendment for increasing alkalinity in acidic soils (Dietzen et al 2018). Improving agricultural productivity is a key priority for many households and countries in the Global South where agriculture remains a major source of livelihoods and economic activity, e.g. employing more than 55% of the labor force in Africa (WMO, 2023).

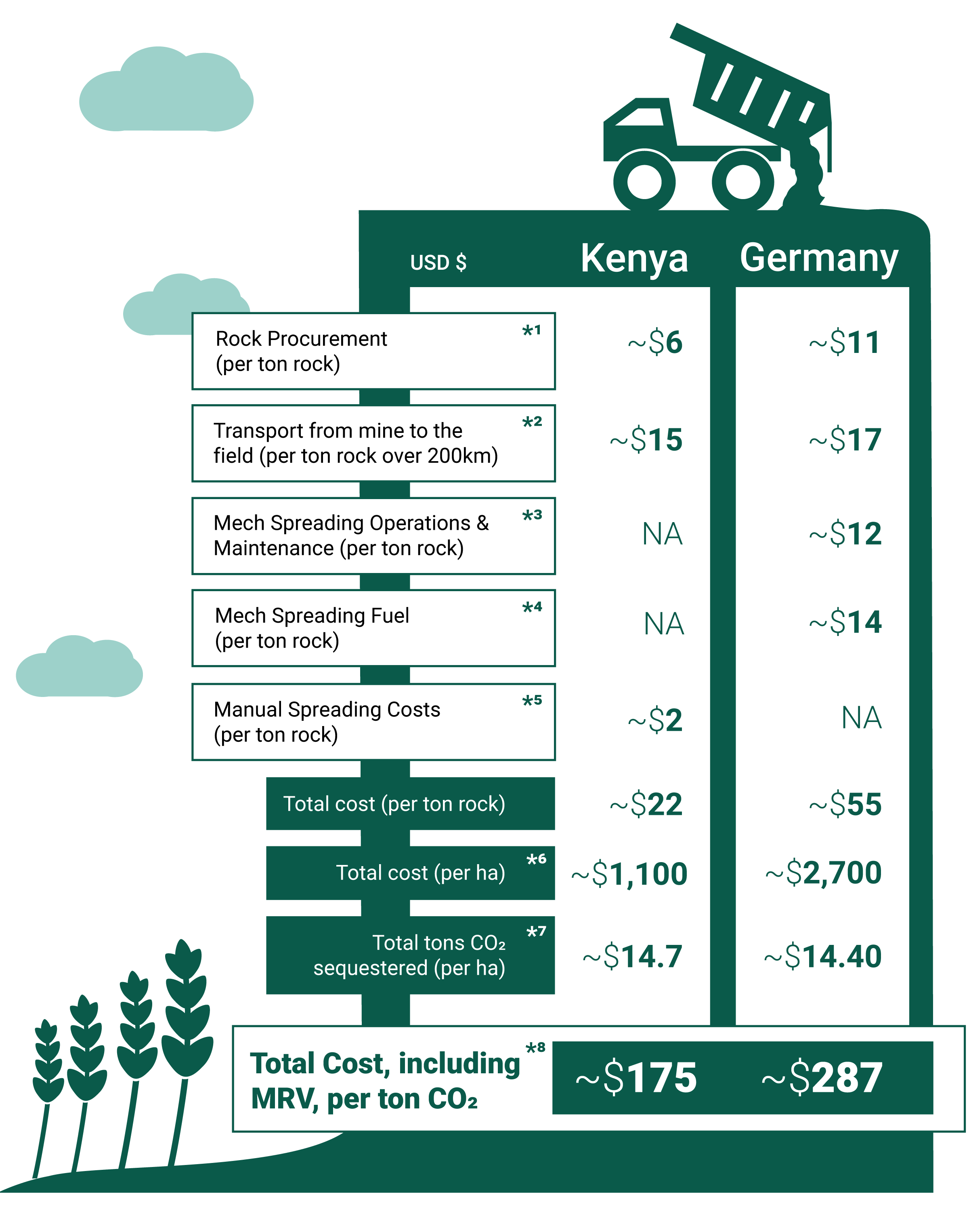

D. A back-of-the-envelope analysis by PxD (see table 1 below) finds that countries in the Global South may have a competitive advantage for ERW deployments – even if carbon removed per hectare were not higher in the Global South – as many of the costs of key deployment activities are substantially lower. CDR has the potential to become a globally important economic activity in which many low-income countries have a competitive advantage, and this can be a significant source of foreign currency earnings for these countries in the years ahead.

PxD used Kenya and Germany as examples of Global South and Global North countries for ERW deployment as we were able to cross-check our model assumptions with on-the-ground information shared from existing pilots. We recognize this back-of-the-envelope analysis makes significant assumptions about ERW activities which may or may not hold up in real-world scenarios, so this analysis should only be interpreted as indicative costing estimates. We welcome any feedback on our cost-benefit analysis and are happy to share the underlying model and its assumptions with sources. Please contact info@precisiondev.org if you have any comments/questions.

*1 Rock procurement costs include mining new rock and grinding rock to 50 microns, the most commonly accepted particle size in literature for optimal carbon removal outcomes.

*2 Assumes a 200 km distance from mine to the field and a linear cost relationship. In reality, transport costs are unlikely to be linear and could decrease significantly for shorter distances.

*3 Kenya: Assumes spreading is done manually due to the nascent nature of the machinery market in the country, so there are no mechanical spreading costs for Kenya.

*4 Kenya: Assumes spreading is done manually due to the nascent nature of the machinery market in the country, so there are no mechanical spreading costs for Kenya.

5* Germany: Assumes spreading is done mechanically due to cost-effectiveness of machinery over labor costs in Global North context, so there are no manual spreading costs for Germany.

6* Assumes a rock application rate of 20 tons/acre (~50 tons/ha) à la (Strefler et al, 2018).

7* Assumes, due to lack of systematic empirical data on how sequestration rates differ in tropical vs temperate geographies, a sequestration rate of 6 tons CO₂/acre and a rock application rate of 20 tons/acre à la (Strefler et al, 2018) for both Kenya and Germany. This estimation accounts for emissions from transport, mechanical spreading if relevant, and grinding. We recognize it is not ultimately realistic to assume a standard rock application rate per hectare and a standard sequestration rate per hectare since the soil conditions of different regions and the types of farms will significantly drive the leakages that need to be accounted for and therefore the resulting cost per net ton.

8* Assumes an MRV cost of $100/ton inclusive of sampling, analysis, verification, and registration. This is an estimate for MRV costs for today’s projects based on weathering applications submitted to Frontier.

In addition to the reasons listed above, catalyzing the ERW market for Global South countries aligns with efforts by many of these countries to change the traditional narrative about their disproportionate vulnerabilities to climate change to one of agency. There is a strong desire by many countries in the Global South to be seen as equal and active participants in the fight against climate change, with high investable potential to contribute to that effort. For example, African leaders at the inaugural Africa Climate Summit in September 2023 advocated for a shift from financing flows only when disasters strike to active investments in building Africa’s green economy. This sentiment is echoed by many indigenous peoples and local communities, like smallholder farming communities, who recognize the effects climate change will wreak on their livelihoods and want to be able to contribute to creating a more sustainable future for themselves (CASH Coalition, 2023).

Credible, cost-effective, and adaptable monitoring, reporting, and verification (MRV) systems currently preclude widespread deployment and monetization of ERW, especially in the Global South

ERW deployments are currently primarily financed through the sale and purchase of carbon removals in voluntary carbon markets, a decentralized marketplace where private entities voluntarily buy and sell carbon credits representing a ton of carbon removed (or reduced). The measurement, reporting, and verification (MRV) of carbon outcomes from carbon credit projects is a critical process in facilitating the flow of finance in voluntary carbon markets as it “seeks to prove that an activity has actually avoided or removed harmful GHG emissions so that actions can be converted into credits with monetary value” (World Bank, 2022). Credible MRV builds trust between buyers and sellers and helps ensure project activities financed through carbon markets are real contributions to climate change mitigation, especially as carbon credits are typically used to “offset” a buyer’s own emissions. In this financing ecosystem, defining a ton of carbon removed with extreme rigor is a prerequisite for the emergence of a deep and liquid market.

Executing highly rigorous MRV approaches for ERW, however, requires significant investment as there is not yet a standard measurement approach and, like for many open-system carbon removal pathways, fundamental questions about the science remain (NASEM, 2019). In the absence of credible models for estimating carbon removal through ERW, quantifying removal amounts requires directly assessing how carbon flows through complex rock weathering interactions with dynamic soil-plant systems, e.g. analysis of soil cores or leachate water. These direct measurement approaches need to be conducted manually, often at the field level, which means they are by nature costly and not easily scaled. And even for these direct measurement approaches, there are still ongoing scientific questions about how much signal they capture with respect to weathering kinetics and ultimate carbon capture and storage (Almaraz et al, 2022).

MRV as a bottleneck for the ERW industry is especially problematic as it is often the major barrier to scale. Physical deployment of ERW requires (a) sourcing and mining appropriate types of rock; (b) finely grinding the rock, and (c) transporting and spreading the ground rock. While creating a deployment model that efficiently conducts these operational steps is by no means simplistic, the technology for these steps is all already available.

In order to address this bottleneck, there have been significant efforts by leading industry stakeholders like Frontier, an advanced market commitment for carbon removal through emerging technologies like ERW, and Cascade Climate, a non-profit accelerating progress in climate interventions that leverage Earth’s natural systems, to help stakeholders align on what rigorous MRV for carbon removal through ERW should look like. Frontier, for example, has established a standard set of enhanced weathering buying principles and Cascade Climate is working to create a community ERW quantification standard. Registries like puro.earth have also recently released methodologies for creating carbon credits from enhanced rock weathering projects, and more movement to establish MRV systems is likely to come as the ERW CDR field grows.

However, in the current carbon market financing ecosystem, much of the investment in MRV innovation is primarily taking place within private firms invested in developing ERW carbon projects. These firms, primarily situated in the Global North where there is existing physical laboratory infrastructure and scientific expertise to support ERW research and often venture capital funded, invest in developing their own MRV approach to help differentiate their carbon credits in the carbon market. Much of the resulting research and innovation to measure carbon removal more cost-effectively and scalably are thus considered proprietary. This dynamic creates high transaction costs for buyers who must decipher different MRV systems and high barriers to market entry for suppliers who must each create their own MRV system from scratch.

Such private sector driven investment in these early days of establishing the ERW industry can thus exacerbate deeply rooted inequities between the Global North and South as knowledge for ERW MRV becomes concentrated in Global North contexts where there is the existing infrastructure, like specialized lab capabilities, academic expertise and willingness to invest. This is likely to create a first-mover advantage for high-income countries, while it remains costly and difficult to implement ERW credibly in Global South landscapes.

For Global South geographies to compete in ERW deployment under current market dynamics of offsetting, there must be sufficient scientific consensus about ERW efficacy and safety in these landscapes, which requires field trial data and ensuring weathering models are calibrated and ground-truthed across a range of climatic and soil conditions. Such a Global South-inclusive research agenda is not currently incentivized in the ERW marketplace, partly because it is extremely costly to do so in environments where the necessary scientific infrastructure is more limited. So while the necessary supply chain components may be in place for ERW in the Global South and climatic conditions are ideal for successful and efficient deployment, the lack of credible, cost-effective, and adaptable MRV currently precludes widespread deployment and monetization.

Innovative finance approaches can help create incentives for the development of inclusive MRV systems for ERW as well shape different forms of CDR demand

In current, ton-denominated carbon markets, MRV is viewed as a private good belonging to the firm that developed a specific approach. Private MRV innovation investment can lead towards a fragmented, inefficient, untrusted market for carbon removals. As a result, we are making unnecessarily slow progress towards an efficient and inclusive market for this cost-effective form of carbon removal which would offer huge potential for earnings for low-income countries and accelerate steps to combat global warming.

Yet, common definitions for weights and measures (i.e. agreement upon what you are trying to measure and verify), and mechanisms to enforce them, have long been considered a public good. Markets cannot function efficiently if the systems of weights and measures that underpin them are uncertain, contested or proprietary. For example, Article 1 of the US Constitution gives Congress the power to “fix the standard of weights and measurement,” and George Washington’s first message to Congress in 1790 called for “uniformity in currency, weights and measures.” Successful market economies depend on the free availability and public enforcement of common standards and units of exchange.

The emergence of an efficient and inclusive market for carbon removals through ERW in the current carbon market financing ecosystem thus requires publicly shared and agreed-upon MRV approaches. This requires investment in ERW R&D across a wide range of geographies including testing, data collection, analysis, and ensuring greater accessibility to specialized laboratory equipment and capacities. Developing a common definition of carbon removal through ERW, although not necessarily a singular MRV method, which is trusted and free-to-use is a global public good that will lead to more efficient markets and increase the confidence of both buyers and sellers.

The status quo of funding MRV innovation in ERW is an example of the classic problem of under-investment in public goods and skewing investment towards already wealthy economies. The challenge is to provide finance for sufficient investment in MRV, including for low-income countries, without creating closed, proprietary systems that lead to an inefficient market. One way for firms to recover the costs of this investment is to charge for the use of the MRV mechanism that they have developed and calibrated – but this is likely to lead to competing, proprietary approaches, and hence the inefficiencies and uncertainty in carbon markets described above.

Innovative financing mechanisms may provide a useful tool to address this financing gap. For example, blended public finance instruments which can help coordinate objectives from various outcome buyers/funders so the significant public and private benefits of MRV innovation are appropriately valued can help bridge the investment gap for MRV as a public good. Pull financing mechanisms, like prizes, advance purchase commitments, off-take agreements or Advanced Market Commitments, could help reshape demand for carbon removal away from ton-denominated offsetting to a more contributions-based approach in which not all the MRV requirements for compensatory claims may be necessary.

PxD is exploring this financing question, in consultation with various industry stakeholders, as the next phase of our work on climate change mitigation within Global South agricultural contexts. In the next few months we will post additional articles outlining our thinking about how to create a Global South inclusive ERW marketplace, including further discussion of innovative financing solutions. We welcome feedback on the ideas we put forward in this article, and future ones, and appreciate different perspectives on this issue. If you would like to get in touch, please contact info@precisiondev.org.

Stay Updated with Our Newsletter

Make an Impact Today